SAPIN 2 software

Accounting control procedures module

Our module dedicated to accounting control procedures and the internal control and audit system meets the requirements of Article 17 of the Sapin 2 law, and above all their interpretation by the French Anti-Corruption Agency.

The benefits of our accounting control procedures module

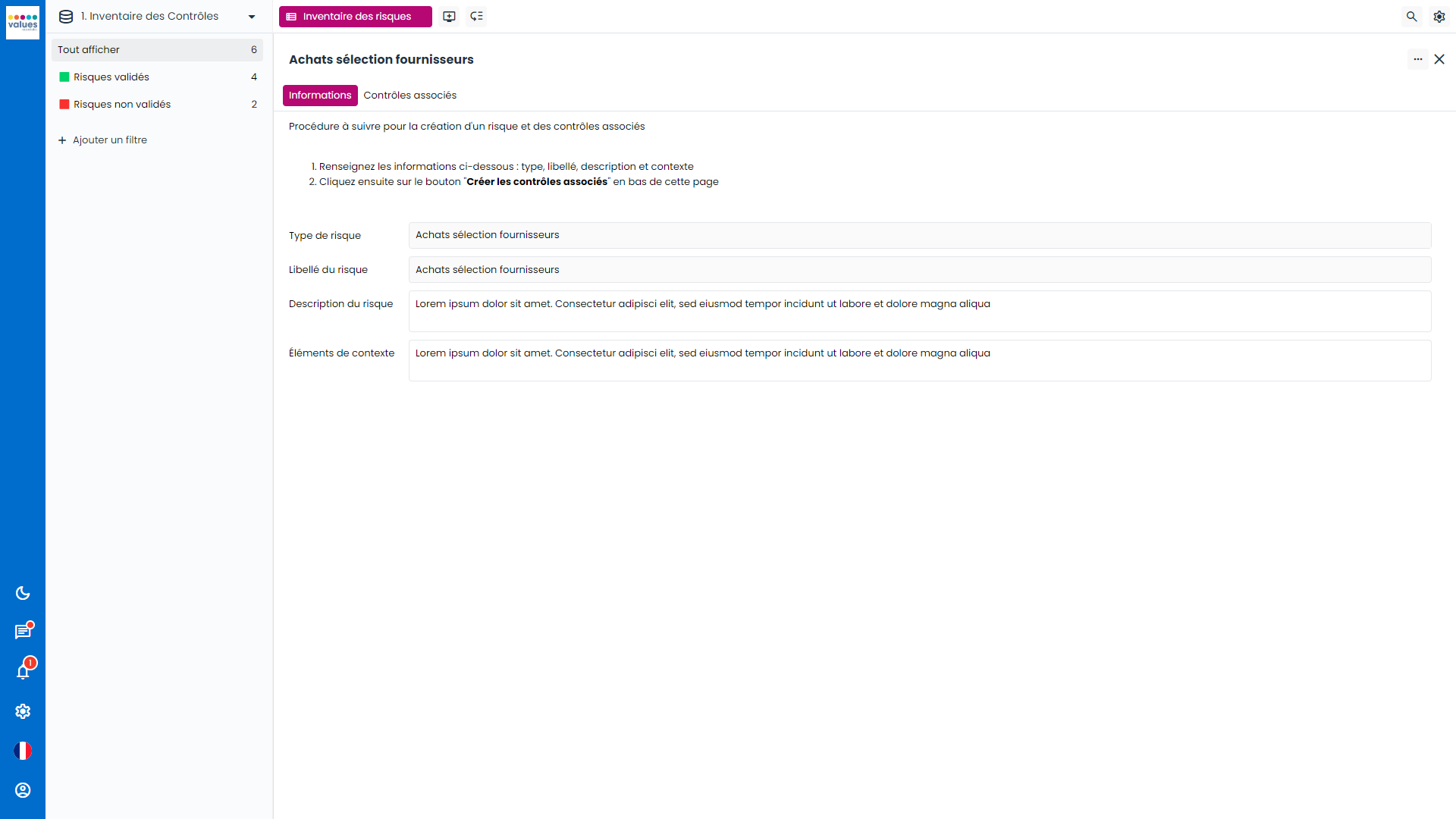

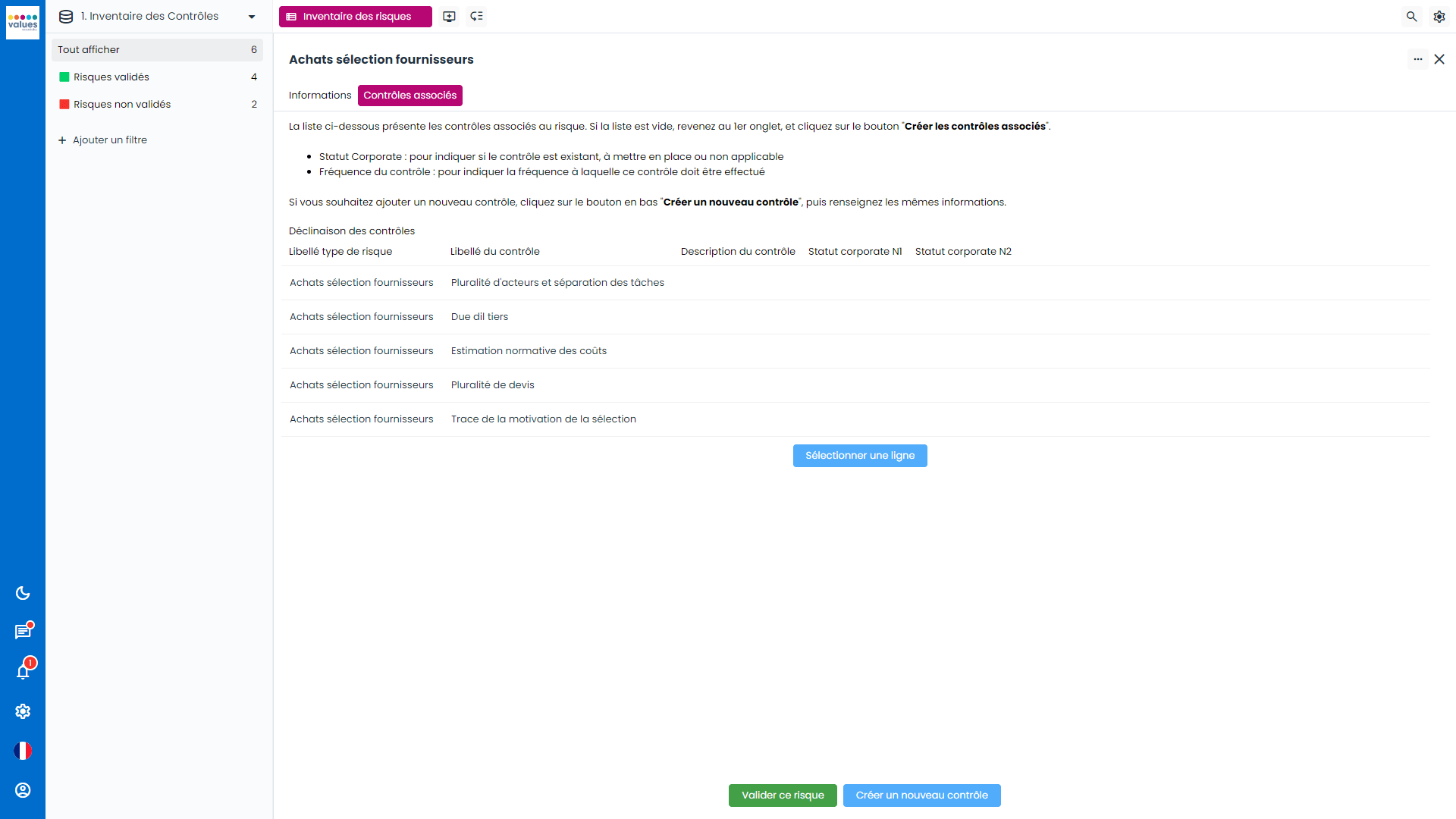

Initiate the inventory of controls and their implementation

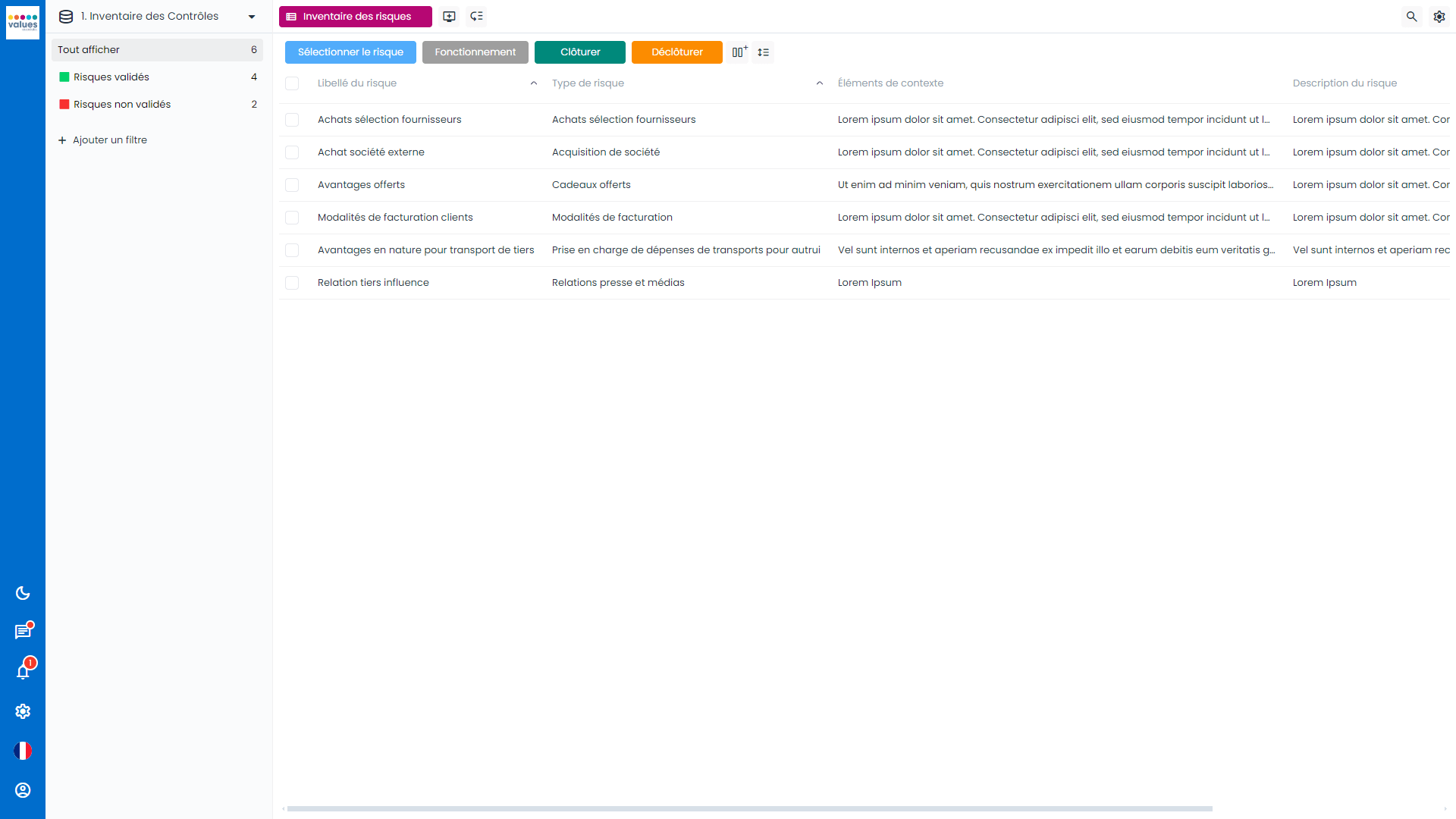

Controls are associated with each of the risks in your corruption risk map and qualified, taking into account their specific needs (existing control, to be implemented or not applicable, frequency, etc.).

All controls identified at central level will be distributed to all entities (BUs, subsidiaries, etc.) according to the actions and third parties concerned, so that they can adjust the qualification of these controls and define any associated actions.

Each iteration of a control is rigorously tracked (status, author of the control (or automatic), due date, date of completion, and filing of proofs of control, etc.), an essential point in guaranteeing your organization’s compliance with the Sapin 2 anti-corruption law.

Manage your system with dynamic, real-time reporting

Ensure regular communication with all stakeholders through indicators and reporting covering the various stages of your system, enabling you to assess and manage the various activities involved in documenting the level 1 and 2 controls associated with your organization’s corruption risk mapping.

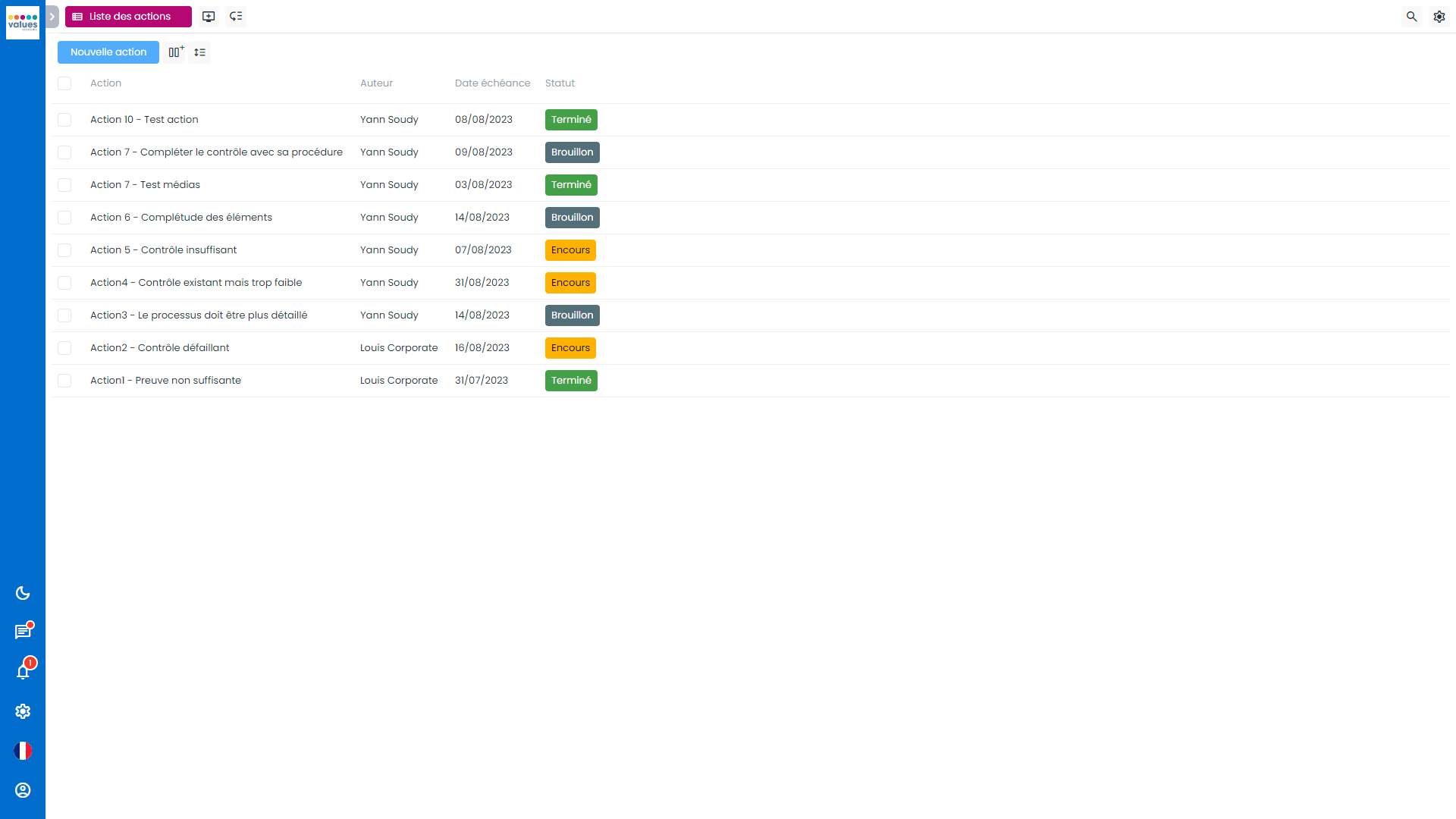

Manage your action plans

Actions are created from a control or directly from the action plan module.

A planning view and dynamic dashboards optimize tracking of action progress and impact

Centralized, up-to-date documentation

Centralize evidence of controls or documents relating to action plans

They’re talking about us…

“The Values Associates team stands out for its great responsiveness, especially when it comes to solving the problems identified. What’s more, they are proactive in suggesting alternative solutions that perfectly match our needs.”

Compliance officer

Interested in our

accounting control procedures software?

Contact us!

VALUES ASSOCIATES undertakes to keep the processed PIIs only for the time necessary for processing, plus the legal limitation periods during which the information will be archived for any accounting, tax or legal claim. Please read our privacy policy for more information on the data processing we carry out and the rights you have regarding your personal data.

What does the Sapin 2 Act say about accounting control procedures and internal control and assessment systems?

According to Law 2016-1691 of December 9, 2016, known as Sapin 2, companies must put in place “accounting control procedures and a system for the internal control and evaluation of the measures and procedures making up the anti-corruption system” and ensure that it “covers the risk situations identified in the mapping of corruption risks”, that it “is adapted to these risks and able to control them” and that it “is regularly updated on the risk situations encountered and the results of the controls carried out”.”

Software designed from the outset for the specific challenges of the Sapin 2 law

The module enables you to document all the control procedures in place (or to be put in place) for each of the risks on your corruption risk map, at group level and subsidiary by subsidiary, thanks to a powerful, intuitive tool based on no-code.

Why choose our accounting control and internal audit software?

Intuitive and customizable, our accounting control software helps you optimize the management of your financial processes and ensure compliance with accounting standards.

100% secure, it offers a high-performance solution for rigorous, efficient control of your financial operations, while respecting the confidentiality of your employees’ data. Whether deployed on its own or in conjunction with the other modules offered by our software suite, accounting control software helps to improve the transparency and accuracy of your financial management.

Manage your accounting processes with even greater precision thanks to our dedicated module.

Centralize, automate and analyze your financial data for greater visibility and control, while facilitating compliance and transparency within your organization.

The accounting control procedures module can be coupled with the other modules of the Values Associates software solution, covering all risk management activities.

FREQUENTLY ASKED QUESTIONS ABOUT ACCOUNTING CONTROL PROCEDURES

What is an accounting control procedure?

Accounting control procedures are systematic processes established to monitor, verify and validate an organization’s financial transactions. They are designed to ensure the accuracy, integrity and compliance of accounting records with applicable standards and regulations.

How do you set up effective accounting control procedures?

To set up effective procedures :

- Document your processes Identify critical tasks and establish clear guidelines for each step.

- Automate controls Use accounting software to automate checks and minimize human error.

- Train your teams Make sure all employees understand the procedures and their importance.

- Conduct regular audits Internal audits: Conduct internal audits to verify the effectiveness of controls and adjust them if necessary.

What are the main types of accounting controls?

The main types of accounting controls include :

- Preventive checks Preventive checks: to avoid errors before they occur.

- Detective checks to identify errors after they have been made.

- Corrective checks to correct detected errors.

- Directive controls to guide employees on how to perform their tasks correctly.

How can a good accounting control system prevent fraud?

By automating controls, ensuring constant monitoring and providing real-time reports, a good accounting control system quickly detects anomalies and suspicious behavior, thus reducing the risk of fraud. The traceability of actions and the historization of data also reinforce the security of financial processes.

What is accounting control software?

Accounting controls software is a computer application designed to help organizations manage, monitor and improve their accounting and financial control processes. Such software is essential to ensure compliance with accounting standards and regulations, as well as to minimize the risk of financial error and fraud.

Why are accounting control procedures important?

These procedures are essential to prevent errors, fraud and financial irregularities. They also ensure compliance with legal and regulatory requirements, reinforce financial transparency, and support informed decision-making within the company.

What accounting standards apply to accounting controls?

Accounting controls must comply with national and international standards such as IFRS (International Financial Reporting Standards), GAAP (Generally Accepted Accounting Principles), and regulations specific to your industry or country, such as the Sapin 2 Law in France.

What role does accounting control software play in these procedures?

Accounting control software helps to automate verification processes, centralize data, guarantee transaction traceability, and improve the speed and accuracy of controls. It also helps meet compliance requirements while optimizing the company’s financial performance.

What are the long-term benefits of robust accounting control procedures?

Robust procedures not only help to minimize financial risks, but also reinforce the company’s credibility with investors, regulators and business partners. They contribute to the organization’s long-term viability by ensuring transparent and reliable financial management.